Ever tried to set up online payments? As it turns out, what should be a simple task is actually quite the nightmare. Whether it’s choosing the right payments company for your billing habits, figuring out how to navigate the complicated maze of setup forms, creating all types of different accounts, or trying to integrate it all with your billing software – it’s pretty messy. Even if you manage to get it set up properly, you still have to deal with multiple companies to handle a simple payments-related issue, and chances are there’s a ton of hidden fees that you just don’t know about. Needless to say, the payments experience for service-based small business owners is broken.

That’s where FreshBooks comes in. Starting today, there’s a new, easy way to accept online credit card payments – and it’s been exclusively designed by FreshBooks with the service-based small business owner in mind, helping you skip all the headaches and reap all the benefits. Curious to see what it’s all about? Keep on reading for the details.

Why should I care?

If you don’t accept online credit cards payments from your clients today, you’re likely spending a ton of time and effort trying to get money you’ve earned into your bank account. Whether you’re chasing clients for checks, constantly having to make bank runs, or manually updating your FreshBooks account every time you get paid, it can get cumbersome.

And let’s face it – even if you already get paid online, your client’s payment experience can be disjointed and confusing (i.e., your client might jump from FreshBooks to another website to pay), manual effort is needed on your part to keep your books up-to-date (ex, adding transaction fees as expenses in your account), or you have to call an entirely separate company to get help on important payment-related matters – what a headache.

Enter: online payments designed and supported by FreshBooks, and integrated directly with your account so that you can:

- Accept credit card payments right away without the painful setup

- Give your clients the easiest and most convenient way to pay your invoices online to help you get paid faster

- Automatically import payment transaction fees as expenses to save you time

- View the status of a payment directly on your Account Dashboard to give you the comfort of knowing what’s happening with your money at all times

- Auto-bill to your hearts content for absolutely no extra charge (that’s right folks – free auto-bills!)

Best of all, it’s backed by FreshBooks’ award-winning support team, so you only have to deal with one company for all your payment-related needs – huzzah!

How does it work?

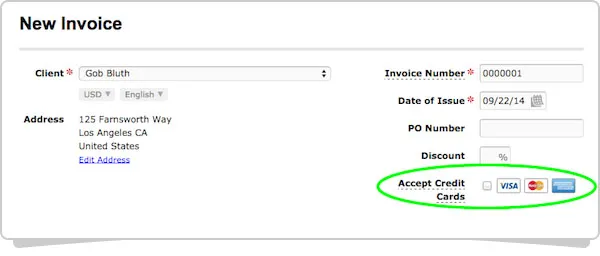

FreshBooks users are already set up to accept credit card payments from the get-go. The next time you’re creating an invoice, you’ll notice a checkbox that prompts you to “Accept Credit Cards”:

Note – if you already get paid online through another online payment gateway (Stripe, PayPal, etc.), you can continue to accept payments as you normally do. You’ll simply see a new option (“FreshBooks”) when creating an invoice that you can choose to enable if you’d like:

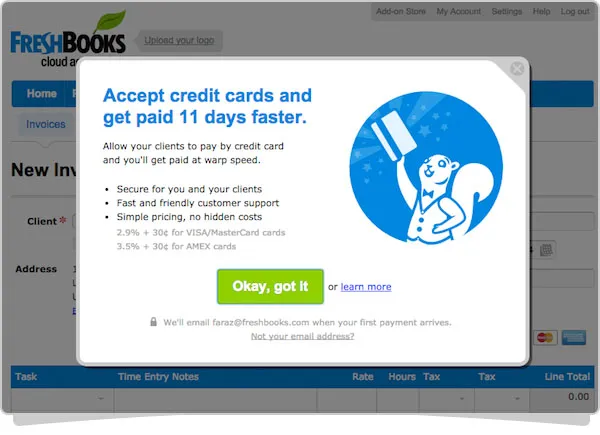

Once you click the checkbox for the first time, you’ll see a pop-up that’ll provide you with more information, including pricing (note – pricing is discussed in detail further below):

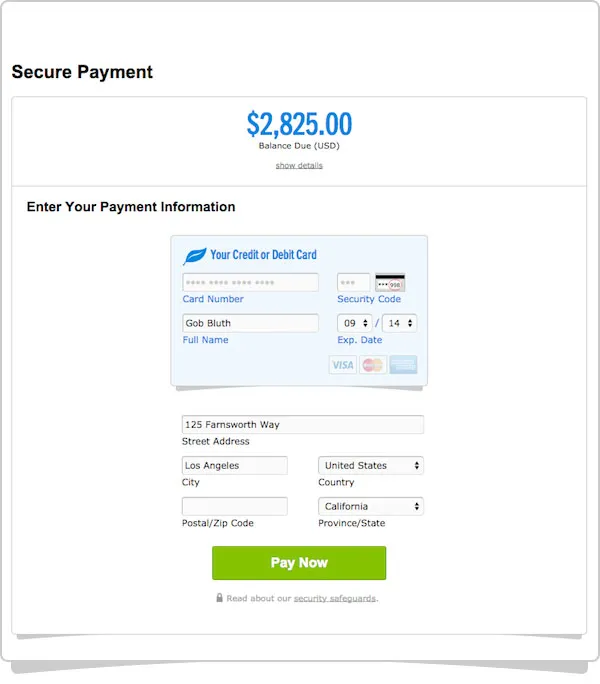

Once you send your invoice and your client clicks on the link in the email, they’ll see the option to “Pay Now”:

Clicking on “Pay Now” will lead your client to a secure, simple payment page, where they can enter their credit card information and pay your invoice in a jiffy – woot!

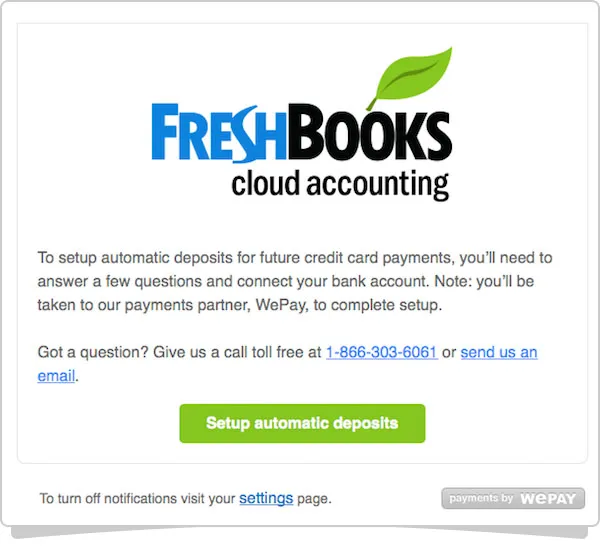

If it’s the first time you’re getting paid online through this route, you’ll receive an email from FreshBooks’ payment partner, WePay, with instructions on how to verify your business and connect your bank account to complete the transaction (note – you only have to do this once):

As soon as your business is verified and your bank account is connected – you’re done! All future payments will appear in your bank account in just a few business days. Side note – WePay is FreshBooks’ payment processor. They’ve processed over $5 billion in payments over the last 5 years! They also have a kick-ass support team (Stevie Award winners) and use advanced risk algorithms that specifically help small business owners just like you get paid even faster. Plus, their platform allows for deeper technology integrations, enabling FreshBooks to serve you even better as time goes on.

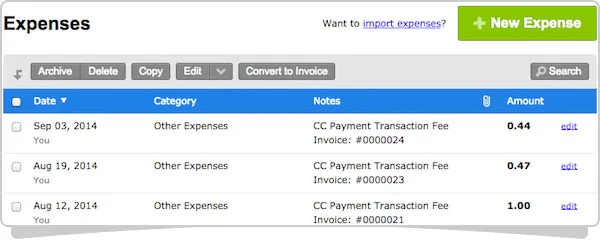

Transaction fees automatically imported as expenses

No more having to calculate transaction fees or manually enter them into your FreshBooks account. FreshBooks will automatically import and categorize transaction fees as an expense every time you get paid:

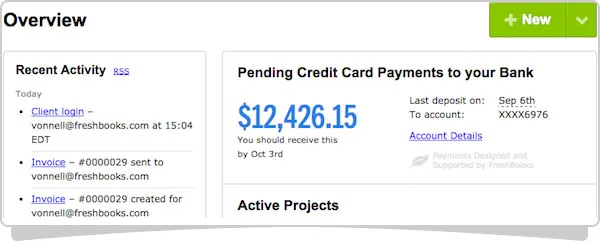

View the status of a payment on the Account Dashboard

Need to know when you should expect to get your hard-earned cash? You’ll get your very own widget right on the Account Dashboard that gives you the comfort of knowing when to expect your next deposit:

How much does it cost?

Pricing is simple and transparent:

- Visa / MasterCard: 2.9% of the payment amount + $0.30 per transaction

- Amex: 3.5% of the payment amount + $0.30 per transaction (Amex is only currently available for U.S customers)

…and that’s it! There are no setup fees, monthly fees, minimum charges, or costs associated with validations or failed transactions. Plus, auto-bills are free so you can really put your billing on cruise control.

What if I’m happy with my current setup?

If you currently use Stripe, PayPal, or any other payment gateway currently supported by FreshBooks, don’t sweat it – your current setup will remain intact and completely unaffected.

Get started today

If you’re ready to give it a whirl, try it out on your next invoice. Note that we’re taking a phased approach to rolling this out for existing FreshBooks users in the U.S and Canada, meaning you’ll receive an email from FreshBooks as soon as it’s enabled for you. If you’ve stumbled on this post without receiving an email and want to give it a go, contact FreshBooks’ Support Team and we’ll turn it on for you.